In the intricate realm of homeownership aspirations, the role of effective mortgage conversations stands paramount. These conversations are the bridge between dreams and reality, where skillful communication not only educates but also builds trust. Delving into the art of mortgage discussions, we uncover the pivotal elements that shape successful transactions and create satisfied homeowners.

Table of Contents

Importance of Effective Mortgage Conversations

Mortgage conversations are not mere transactions; they are the seeds of a lasting relationship. From the initial inquiry to post-closing follow-up, every interaction paves the way for informed decisions and confident choices. Effective communication forms the bedrock of these exchanges, setting the tone for seamless transactions and empowered homeowners.

Building Trust and Rapport

- Engendering Confidence: Cultivating an environment of trust where borrowers comfortably share their financial goals and concerns.

- Personalized Engagement: Tailoring conversations to each borrower, showcasing a genuine commitment to their journey.

Exploring Borrower Needs and Goals

- Listening Intently: Attentively understanding borrowers’ objectives, anxieties, and preferences to offer solutions that align.

- Unveiling Financial Capacity: Delving into borrowers’ financial profiles to recommend mortgage options that resonate.

Once you have built trust and rapport with borrowers, you can start to explore their needs and goals. Here are some questions you can ask to get a better understanding of their situation:

- What is your budget for a mortgage?

- What is your desired interest rate?

- How long do you plan to stay in the home?

- What are your other financial goals?

- What are your concerns about the homebuying process?

Navigating Complex Financial Terms

Mortgages can be complex, so it is important to be able to explain the terms in a way that borrowers can understand. Here are some tips for navigating complex financial terms:

- Use simple language and avoid jargon.

- Break down complex concepts into smaller, more manageable pieces.

- Use visuals, such as charts and graphs, to help borrowers visualize the concepts.

- Be patient and willing to answer questions.

Clear Communication of Mortgage Options

- Holistic Presentation: Providing a comprehensive view of mortgage choices, elucidating the advantages and implications of each.

- Visual Aids: Employing visual aids to illustrate the impact of different options, aiding borrowers’ understanding.

Once you have a good understanding of borrowers’ needs and goals, you can start to discuss mortgage options. Here are some tips for communicating mortgage options clearly:

- Present all of the options available to borrowers, including the pros and cons of each.

- Explain the terms of each option in detail.

- Help borrowers compare the different options and choose the one that is right for them.

Addressing Concerns and Questions

- Open Dialogue: Encouraging borrowers to voice uncertainties and questions, offering thorough explanations and clarity.

- Proactive Problem-Solving: Addressing common concerns preemptively, such as prepayment penalties or adjustable rates.

Mortgages can be a complex financial product, so it is important to be prepared to answer borrowers’ questions and concerns. Here are some tips:

-

Be open and honest. Do not sugarcoat anything.

-

Use simple language. Avoid jargon and technical terms.

-

Be patient. Borrowers may have a lot of questions.

-

Be willing to answer follow-up questions.

-

Use visuals. Charts and graphs can help borrowers understand complex concepts.

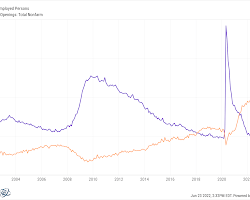

Transparency in Interest Rates and Fees

- Full Disclosure: Transparently revealing interest rates, fees, and potential charges, establishing trust through openness.

- Comparative Insights: Presenting competitive breakdowns of costs and rates from diverse lenders, empowering borrowers.

Opens in a new window

Opens in a new window www.quickenloans.com

www.quickenloans.com

Providing Timely Updates and Information

- Responsive Engagement: Swiftly responding to inquiries, providing updates during the application process, and maintaining clarity.

- Proactive Communication: Keeping borrowers abreast of milestones, approvals, and documentation requirements.

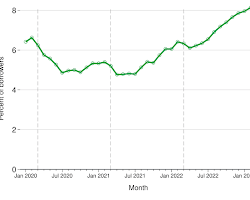

Handling Mortgage Refinancing Discussions

- Benefits Assessment: Collaboratively evaluating the potential advantages of refinancing, factoring in current rates and goals.

- Cost Clarity: Detailing costs, savings, and long-term implications of refinancing, aiding borrowers’ decision-making.

Opens in a new window

Opens in a new window www.investopedia.com

www.investopedia.com

Supporting First-Time Homebuyers

- Educational Empowerment: Guiding first-time buyers through mortgage complexities, clarifying terms, down payments, and eligibility.

- Patient Navigation: Allowing ample time for explanations and addressing anxieties inherent in first-time purchases.

Handling Difficult Conversations

- Sensitive Situations: Approaching sensitive matters like credit challenges with empathy, offering viable solutions.

- Alternative Pathways: Proposing alternate routes such as credit repair or loan modification to assist borrowers.

Embracing Digital Communication Tools

- Virtual Connectivity: Leveraging digital tools for virtual consultations, streamlined document submissions, and real-time updates.

- Convenience Amplification: Meeting borrowers in the digital realm, aligning with their preferences for smoother interactions.

Collaborating with Real Estate Professionals

- Unified Approach: Maintaining fluid communication with real estate agents, ensuring cohesive support for borrowers.

- Combined Expertise: Merging insights for comprehensive guidance encompassing both homebuying and mortgages.

Cultural Sensitivity and Communication

- Respectful Engagement: Acknowledging cultural diversity, ensuring communication resonates across varied backgrounds.

- Preventing Assumptions: Avoiding assumptions tied to cultural differences, encouraging open and respectful dialogue.

Ensuring Compliance and Legal Clarity

- Regulatory Alignment: Staying current with mortgage regulations to provide accurate and compliant information.

- Legal Understanding: Ensuring borrowers comprehend legal terms, contracts, and obligations prior to commitment.

Personalizing Mortgage Solutions

- Tailored Strategies: Crafting mortgage solutions that harmonize with borrowers’ unique financial landscapes and ambitions.

- Customized Exemplification: Presenting personalized scenarios showcasing mortgage flexibility and adaptability.

Balancing Empathy and Professionalism

- Human Connect: Balancing empathy with professionalism, establishing rapport while delivering expert guidance.

- Navigating Emotions: Recognizing the emotional aspect of homeownership, providing pragmatic solutions with sensitivity.

Post-Close Follow-Up and Support

- Continual Engagement: Offering sustained support post-closing, addressing queries and ensuring a seamless transition.

- Enduring Relationships: Nurturing enduring relationships, beyond transactions, to become a trusted financial advisor.

“Effective mortgage conversations are not just about transactions; they’re about building trust and empowering borrowers to make informed decisions. Through clear communication and understanding, we pave the way for confident home ownership.”

Sarah Johnson

Conclusion

Mortgage conversations are the compass that navigates homeownership journeys. These conversations empower borrowers, shape decisions, and transform dreams into reality. By embracing communication mastery and client-centric approaches, mortgage professionals lay the foundation for successful transactions, while creating an indelible impact on the lives of homeowners.

Read more articles