The burden of medical debt is a pressing issue faced by countless individuals and families around the world. As healthcare costs continue to rise, many find themselves grappling with the financial aftermath of unexpected medical emergencies and necessary treatments.

Table of Contents

The Realities of Healthcare Costs

Navigating the complexities of medical debt starts with understanding the realities of healthcare costs. From prescription medications to hospital stays, even seemingly routine procedures can quickly accumulate into substantial bills.

Personal Stories of Medical Debt

Personal narratives shed light on the profound impact of medical debt on individuals’ lives. These stories humanize the issue and highlight the far-reaching consequences that ripple through families and communities.

The Emotional Toll of Financial Strain

Beyond the financial implications, medical debt can take an emotional toll, causing stress, anxiety, and a sense of helplessness. Emotional well-being often becomes intertwined with financial stability.

Understanding the Healthcare System

A fundamental step in managing medical debt is understanding the healthcare system itself. Knowledge of insurance coverage, billing procedures, and common practices empowers individuals to navigate the system more effectively.

Insurance Coverage and Limitations

Insurance coverage plays a pivotal role in mitigating medical expenses. However, understanding policy details, deductibles, copayments, and limitations is essential to avoid unexpected financial setbacks.

Negotiating Medical Bills

Effective communication and negotiation with healthcare providers can lead to reduced medical bills. Exploring payment plans or negotiating for discounts can alleviate the burden of overwhelming debt.

Seeking Financial Assistance Programs

Financial assistance programs provided by hospitals, clinics, and government agencies offer a lifeline for individuals struggling with medical debt. These programs can provide much-needed relief and support.

Budgeting for Medical Expenses

Incorporating medical expenses into one’s budgeting strategy is key to maintaining financial stability. Allocating funds for potential medical costs helps prevent unexpected debt accumulation.

Opens in a new window

Opens in a new window www.freepik.com

www.freepik.com

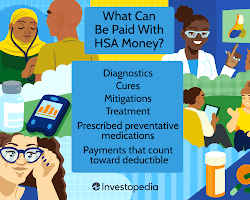

Preventive Measures: Health Savings Accounts

Health savings accounts (HSAs) offer a proactive approach to managing medical expenses. These accounts allow individuals to set aside pre-tax funds for medical needs, providing a safety net against debt.

Opens in a new window

Opens in a new window www.investopedia.com

www.investopedia.com

Legal Rights and Consumer Protections

Understanding legal rights and consumer protections related to medical debt is crucial. Knowledge of regulations and laws can empower individuals to challenge erroneous charges and unfair practices.

Community Support and Resources

Communities and online platforms offer valuable resources for navigating medical debt. Support groups, financial advisors, and nonprofit organizations provide guidance and solidarity.

Opens in a new window

Opens in a new window www.freepik.com

www.freepik.com

Dealing with Collection Agencies

Facing collection agencies can be intimidating, but knowing one’s rights when dealing with debt collectors is empowering. Being aware of regulations can prevent harassment and ensure fair treatment.

Mental and Emotional Well-being

Caring for mental and emotional well-being is essential while managing medical debt. Seeking counseling, practicing self-care, and maintaining a support network contribute to overall resilience.

Opens in a new window

Opens in a new window www.everydayhealth.com

www.everydayhealth.com

Empowering Financial Literacy

Educating oneself about personal finance and financial literacy is a long-term strategy to prevent and address medical debt. Understanding money management principles builds financial resilience.

Advocating for Policy Change

Advocacy for policy changes at local and national levels is essential to address systemic issues contributing to medical debt. Joining advocacy efforts can create lasting change.

Balancing Health and Finances

Striking a balance between prioritizing health and managing finances is a delicate challenge. Making informed healthcare decisions while considering financial implications is crucial.

Success Stories: Overcoming Medical Debt

Success stories of individuals who have successfully navigated and overcome medical debt provide inspiration and actionable strategies for others facing similar challenges.

Moving Forward: Building Financial Resilience

Building financial resilience involves creating a comprehensive plan for managing medical expenses and future uncertainties. Emergency funds, insurance coverage, and proactive financial strategies contribute to resilience.

“Navigating medical debt is not just about financial management; it’s a journey of empowerment, resilience, and regaining control over your well-being.”

Emma Carter

Moving Forward: Building Financial Resilience

Building financial resilience involves creating a comprehensive plan for managing medical expenses and future uncertainties. Emergency funds, insurance coverage, and proactive financial strategies contribute to resilience.

- Emergency funds: An emergency fund is a savings account that can be used to cover unexpected expenses, such as medical bills. Having an emergency fund can help people avoid going into debt when they experience a financial setback.

- Insurance coverage: Insurance can help protect people from financial losses due to medical expenses. There are a variety of insurance options available, so it is important to shop around and find the best plan for your needs.

- Proactive financial strategies: There are a number of proactive financial strategies that people can use to build financial resilience. These strategies may include budgeting, saving, and investing.

By taking these steps, people can build a financial foundation that will help them weather the storms of life, including medical debt.

Some additional resources that you may find helpful:

- National Consumer Law Center: The National Consumer Law Center is a nonprofit organization that provides legal assistance and advocacy for low-income consumers. They have a website with information about medical debt, including how to negotiate with creditors and how to file for bankruptcy.

- Patient Advocate Foundation: The Patient Advocate Foundation is a nonprofit organization that helps people with medical debt. They offer free counseling and assistance with negotiating bills, applying for financial assistance, and filing for bankruptcy.

- National Foundation for Credit Counseling: The National Foundation for Credit Counseling is a nonprofit organization that provides credit counseling and debt management plans. They can help you create a budget and manage your debt, including medical debt.

- Debt.org: Debt.org is a website that provides information about debt, including medical debt. They have a forum where you can connect with other people who are struggling with medical debt and get advice.

- The Balance: Medical Debt: The Balance is a website that provides financial advice. They have an article about medical debt that includes tips on how to manage it.

Conclusion: A Roadmap to Financial Recovery

Navigating medical debt is a journey that requires a combination of knowledge, resources, and resilience. By understanding healthcare systems, seeking assistance, and fostering financial literacy, individuals and families can pave a roadmap to financial recovery, reclaiming control over their lives and well-being.

Read more articles