Embarking on a journey to accumulate $50,000 necessitates careful financial navigation. This comprehensive guide sheds light on the strategic steps to adopt and pitfalls to avoid as you tread the path toward your savings milestone.

Table of Contents

Introduction: Laying the Foundation for Financial Triumph

The pursuit of a financial objective, such as amassing $50,000 in savings, mirrors your dedication to securing a prosperous future. Yet, this journey is riddled with critical decisions that can significantly shape your financial landscape. By delving into actionable strategies and steering clear of potential traps, you can refine your approach and ensure your financial resilience aligns with your goals.

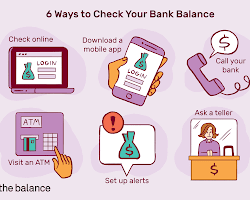

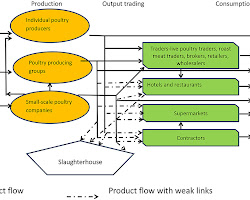

Opens in a new window

Opens in a new window www.thebalancemoney.com

www.thebalancemoney.com

Setting the $50,000 Milestone: Picturing Triumph

Mapping the Route:

- Firmly establishing the $50,000 milestone as a pivotal objective that embodies your commitment to financial growth.

- Envisioning the tangible accomplishments and prospects that this milestone unlocks.

Opens in a new window

Opens in a new window kernelwealth.co.nz

kernelwealth.co.nz

Avoiding High-Interest Debt: Safeguarding Progress

Steering Clear of Debt Detours:

- Exercising vigilance to steer away from high-interest debt that could erode your savings endeavors.

- Implementing a targeted debt repayment strategy to pave the way for unobstructed savings growth.

Opens in a new window

Opens in a new window www.bairdwealth.com

www.bairdwealth.com

Steering Clear of Impulsive Purchases: Mindful Financial Navigation

Mindful Consumption:

- Cultivating intentional spending habits that harmonize with your savings objectives.

- Embracing a contemplative pause before making purchases to thwart impulsiveness and prioritize financial well-being.

Opens in a new window

Opens in a new window acultivatednest.com

acultivatednest.com

Opens in a new window

Opens in a new window www.amazon.com

www.amazon.com

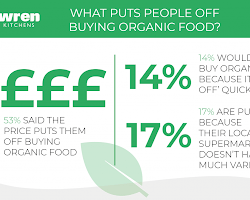

Postponing Major Financial Commitments: A Strategic Approach

Timing Matters:

- Delaying substantial financial commitments, like sizeable purchases or investments, until after reaching your savings target.

- Channeling resources into fortifying your financial bedrock before embarking on significant financial undertakings.

Opens in a new window

Opens in a new window www.wrenkitchens.com

www.wrenkitchens.com

Opens in a new window

Opens in a new window www.thebalancemoney.com

www.thebalancemoney.com

Resisting Lifestyle Inflation: Balancing Financial Harmony

The Temptation of More:

- Safeguarding against lifestyle inflation, wherein increased earnings inadvertently lead to escalated expenses.

- Deliberately managing your lifestyle to allocate surplus funds toward your savings ambition.

Opens in a new window

Opens in a new window www.frontiersin.org

www.frontiersin.org

Sidestepping Risky Investments: Prudent Financial Navigation

Navigating Investment Waters:

- Approaching high-risk investments with judicious caution to shield your hard-earned savings.

- Prioritizing diversified and thoroughly researched investment avenues aligned with your risk tolerance.

Opens in a new window

Opens in a new window www.freepik.com

www.freepik.com

Opens in a new window

Opens in a new window rowling.com

rowling.com

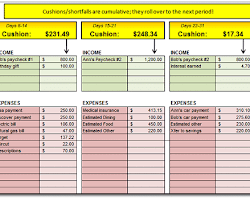

Cautious Approach to Loans: Balancing Debt Dynamics

Loan Considerations:

- Exercising meticulous scrutiny when considering loans, evaluating their long-term impact on your financial trajectory.

- Opting for loans with favorable terms and explicit repayment strategies to mitigate interference with your savings goal.

Opens in a new window

Opens in a new window www.freepik.com

www.freepik.com

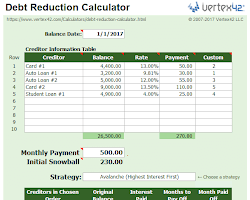

Opens in a new window

Opens in a new window www.vertex42.com

www.vertex42.com

Minimizing Frivolous Expenses: Resourceful Resource Allocation

Expense Scrutiny:

- Analyzing your expenses to identify and eliminate discretionary outlays that could hinder savings progress.

- Redirecting these funds to bolster your savings corpus and expedite your journey.

Opens in a new window

Opens in a new window www.sumup.com

www.sumup.com

![]() Opens in a new window

Opens in a new window www.pinterest.com

www.pinterest.com

Prioritizing Emergency Fund Growth: A Safety Net for Financial Security

Emergency Preparedness:

- Placing heightened emphasis on growing your emergency fund to address unforeseen fiscal exigencies.

- Aspiring for an emergency fund capable of covering essential expenses for three to six months, buttressing your savings expedition.

Opens in a new window

Opens in a new window www.communityfirstfl.org

www.communityfirstfl.org

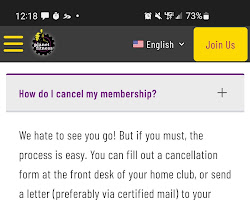

Shunning Unnecessary Subscriptions: Streamlining Financial Commitments

Subscription Audit:

- Engaging in a thorough evaluation of subscription services, relinquishing those that lack alignment with your priorities.

- Funneling subscription expenses into your savings fund to reinforce your financial underpinning.

Limiting Luxurious Spending: Conscious Luxuries, Informed Choices

Luxury Deliberation:

- Practicing mindfulness in luxury expenditures, appreciating the delicate equilibrium between indulgence and fiscal prudence.

- Treating yourself occasionally while maintaining unwavering focus on your savings odyssey.

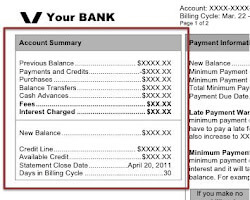

Avoiding Overreliance on Credit: Managing Borrowing Responsibly

Credit Caution:

- Exercising restraint in depending excessively on credit cards for everyday expenditures to forestall debt accumulation.

- Employing credit cards judiciously and settling balances expeditiously to circumvent accruing interest charges.

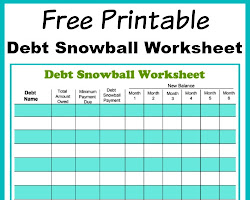

Strategic Debt Management: Navigating Debt Terrain

Debt Management Strategy:

- Tackling prevailing debts systematically, giving precedence to high-interest debts for swifter repayment.

- Devising a structured plan that concurrently addresses debt management while advancing your savings pursuit.

Safeguarding Retirement Contributions: Ensuring Long-Term Resilience

Future-Focused Vigilance:

- Sustaining contributions to retirement funds as a means to safeguard long-term financial stability.

- Striking equilibrium between retirement savings and immediate savings objectives for a holistic financial approach.

Balancing Immediate Gratification and Long-Term Goals: Harmonizing Desires

Balanced Symphony:

- Synthesizing immediate gratification with enduring aspirations through a balanced outlook.

- Infusing intermittent indulgences while unwaveringly adhering to your comprehensive financial blueprint.

Making Informed Financial Decisions: The Power of Knowledge

Informed Decision-Making:

- Acquiring knowledge and seeking expert counsel prior to pivotal financial choices.

- Aligning each decision with your savings and fiscal goals for a well-informed trajectory.

Staying Committed to the Savings Goal: The Fortitude of Persistence

Persistent Pursuit:

- Cementing your dedication to the $50,000 savings milestone, unswayed by obstacles or diversions.

- Nurturing discipline and resilience as you traverse the course toward realizing your fiscal aspiration.

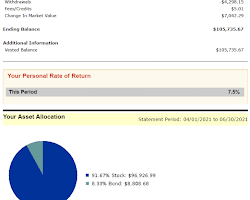

Investing Wisely After Reaching the Milestone: Transcending the Goal

Progress Beyond the Milestone:

- Exploring investment prospects that extend beyond the $50,000 target, fostering continuous financial expansion.

- Transitioning from savings accumulation to strategic investment to bolster fiscal empowerment.

Investing Wisely After Reaching the Milestone: Transcending the Goal

Progress Beyond the Milestone:

- Exploring investment prospects that extend beyond the $50,000 target, fostering continuous financial expansion.

- Transitioning from savings accumulation to strategic investment to bolster fiscal empowerment.

Investing Wisely:

After successfully reaching your $50,000 savings milestone, your financial journey continues with a new phase: strategic investment. While the milestone itself is a remarkable achievement, it’s essential to consider how your money can continue working for you and growing over time. Here are some key considerations for wise post-milestone investments:

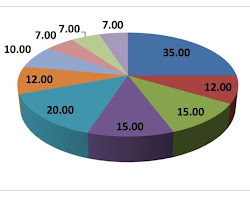

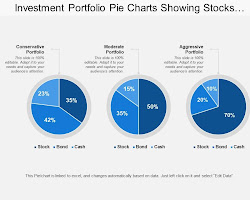

Diversification:

- Spread your investments across different asset classes, such as stocks, bonds, real estate, and even alternative investments like precious metals or cryptocurrencies.

- Diversification helps mitigate risks and maximizes the potential for returns, ensuring that your investments are not overly reliant on a single source.

Risk Tolerance:

- Assess your risk tolerance and investment horizon. Are you comfortable with higher-risk, potentially higher-reward investments, or do you prefer a more conservative approach?

- Consider your long-term goals, such as retirement or other major life expenses, and align your investments accordingly.

Professional Guidance:

- Consult with financial advisors or investment professionals to develop a tailored investment strategy that aligns with your goals and risk profile.

- Professional guidance can provide you with valuable insights, help you avoid common investment pitfalls, and optimize your portfolio.

Continuous Learning:

- Stay informed about market trends, economic indicators, and industry developments that could impact your investments.

- Continuous learning empowers you to make informed decisions and adapt your investment strategy as needed.

“Every dollar saved is a step closer to financial freedom and peace of mind.”

Jane Smith

Conclusion: A Beacon of Financial Accomplishment

Your voyage toward accruing $50,000 in savings necessitates unwavering commitment, purposeful decisions, and astute evasion of common financial pitfalls. By navigating this path diligently and with sagacity, you pave the way for a future characterized by financial stability, resilience, and triumph.

With your milestone achieved and your investment journey underway, you’ve set the stage for continued financial growth and success. Remember that financial wisdom is a lifelong journey—one that requires ongoing learning, prudent decision-making, and the flexibility to adapt to changing circumstances.

As you progress beyond the $50,000 goal, carry forward the lessons you’ve learned and the principles you’ve embraced. Your dedication to financial prudence will continue to guide you toward greater financial security, empowerment, and a future filled with possibilities.

Read more articles